Methodology

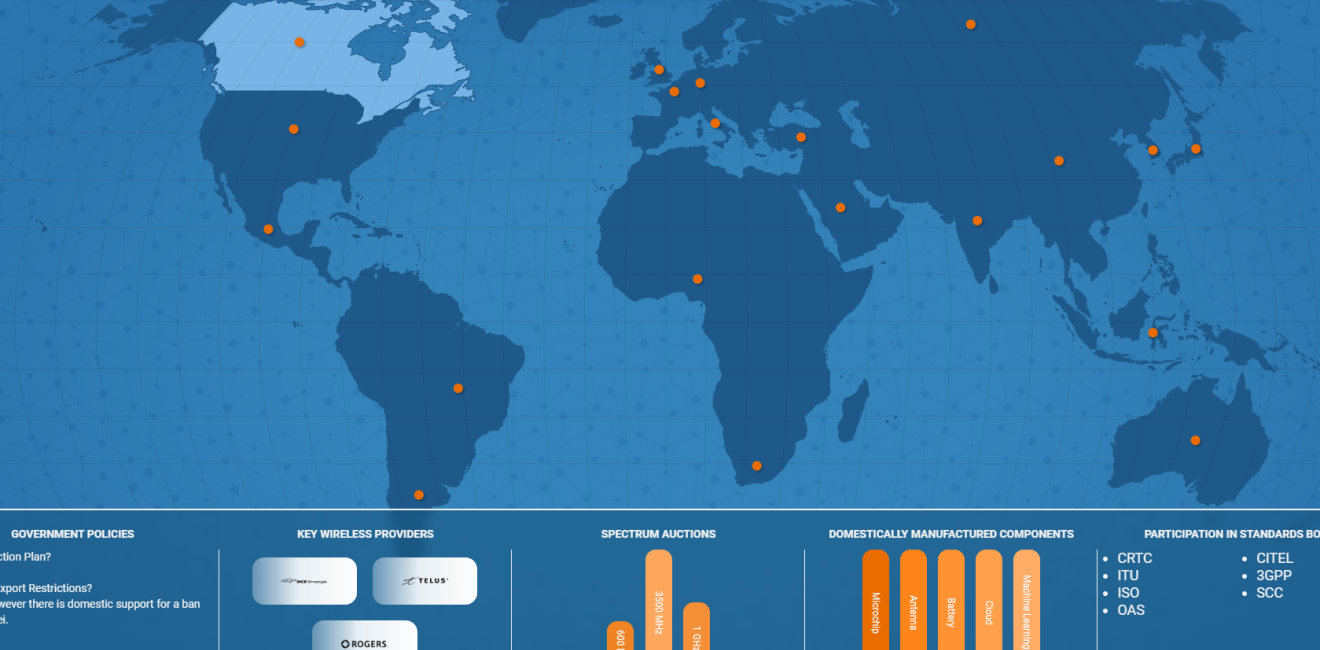

5G Around the Globe was created to capture a snapshot of the global landscape of fifth-generation (5G) wireless technology to better understand different geostrategic approaches, providing decision-makers a tool to learn from and engage with 5G technology and policy options. We selected a case study approach of twenty countries, focusing on key factors of leadership and capacity, ranging from participation in international standard bodies to government policies to private sector performance. This required qualitative analyses of policies and key stakeholders, as well as technical analyses of the supply chain, manufacturing, and spectrum allocation. Here, we have broken down that process to underscore the data collected and how we interpreted it for the infographic.

Sampling

Our research effort began by selecting a representative small sample of countries around the world. We selected the Group of 20, or G20, as our representative sample for several reasons. First, these countries demonstrated different stages of development -- as opposed to other bodies which may have underrepresented developing nations. Second, the G20 is inclusive across six continents (excluding Antarctica). From this sample, we did exclude non-country actors, such as the European Union, in order to maintain a country-to-country means of comparison.

Variables

We sought to create categories of information that would provide insight into a country’s orientation towards 5G. We wanted to operationalize existing information in such a way that it would capture the current domestic approach to 5G (e.g. government policies, key wireless providers, spectrum auctions, domestically manufactured components), as well as relevant international 5G efforts (e.g. global stakeholders, participation in standards bodies). In defining these categories further, consideration was taken into how to standardize our approach across all G20 countries to ensure each country was being measured on the same scale.

Sources

Key sources of data that were studied include: online public records, such as government issued documents; peer-reviewed articles; reputable news sources; company and organization websites; and public statements and press releases from media and government. Depending on the variable, some sources were used more than others -- e.g. for government policies, a primary data source was government records.

Government Policies

Research Question: What, if any, federal government policies are in place that relate to the governance of 5G?

Answering this question helped define how political and regulatory environments drive 5G adoption in each country, as well as what stage of 5G deployment a nation was undergoing. Analyzing the 5G policies of each country was an important first step in capturing what 5G looked like domestically, and how a particular country’s policies fit into our snapshot of 5G around the world.

There was some inconsistency in the level of political action or policy among our sample. Some countries had thorough national action plans, while others altogether lacked a government-led 5G strategy. Some countries had placed tight restrictions on foreign technology imports, while others had yet to hold security reviews of those same technologies. In some instances the policies were nuanced; countries had issued partial bans of foreign technology, only allowing hardware integration in the non-core parts of its 5G network. Given this variability across countries, the definition of what to include was kept broad. This is one reason we operationalized these categories by linking the respective policies in the infographic, to best represent the range of policy options available. However, we were able to hone our search to three broad categories: a national action plan, import or export restrictions, and any additional policies relating to 5G.

National Action Plan. This encapsulated a government-planned strategy or roadmap for 5G deployment. These were often issued by the federal governments themselves, or other federal bodies dealing with telecommunications, such as the United States’ Federal Communications Commission (FCC) or France’s Autorité de Régulation des Communications Électroniques et des Postes (ARCEP). Helpful resources that better illustrate this category are the 5G Strategy for Germany and South Korea’s 5G+ Strategy.

Import or Export Restrictions. Given the prevalence of security concerns in global discourse, we wanted to provide a snapshot of which countries had made efforts to restrict or ban foreign technology or companies from domestic 5G deployment. These types of policies, which overwhelmingly focused on Chinese multinational firms such as Huawei and ZTE, were found in the form of government statements or reviews from federal security bodies, and to a lesser degree in the form of sweeping executive orders on foreign technologies.

Additional Policies. The final subsection included any additional policies related to 5G that did not necessarily fit into the aforementioned two categories, including spectrum policies, more general broadband plans, additional security-related laws, and policies on 5G partnerships and international cooperation.

Spectrum Auctions

Research Question: What, if any, spectrum auctions had occurred or were planned for 5G?

Often, spectrum auctions are the first step in a country’s 5G strategy. Our analysis for this section included past spectrum auctions, planned spectrum auctions, and available spectrum frequencies for 5G. Our research found that spectrum allocations were typically administered by governments and sold in auctions to the highest industry bidder. In a select few countries, spectrum is directly assigned to certain telecommunications companies without a bidding process. In general, our research found that some countries’ telecommunications companies are run and owned by the state, while in others, they are wholly private or publicly owned enterprises. In other countries with less developed 5G plans, auctions had yet to occur altogether. We captured this variance by either noting the dates in which spectrum allocation had occurred, or that they had not, as well as what bandwidths were currently available. This may in fact have an impact on the resulting spectrum allocation process on a country-by-country basis.

Key Wireless Providers

Research Question: Who are the key wireless providers in the country?

This section of our country analysis answered who the primary telecommunications companies were in each nation, and how involved they were the country’s 5G rollout. Exploring the available data, there were inconsistencies both within countries as well as companies on their approach to 5G. Per country, the number of wireless providers active in the 5G space was one of significant variance. Within companies, there were significant discrepancies in organizational structure (state-run, wholly private, or publicly traded), thus blurring the line between government action and organic market forces. Our team addressed this by including wireless providers that were also building 5G capacity and capabilities for near term use. In some countries, the list included companies that are currently involved in domestic 5G rollout. In other countries, where 5G deployment is in its early stages, we expanded the scope to include companies that have run 5G trials, set up test beds in specific locations, or hold a marked presence in the industry.

Participation in Standards Bodies

Research Question: What standards are reflected in the country’s international and domestic approach?

Standards have the potential to impact everything from international trade and security to global norms surrounding technology. Furthermore, norm creation and standards setting provides valuable insight into the regulatory impact a country has on the global adoption of 5G technology. Data for this section specifically integrated international, regional, and domestic standards bodies and their relevant subsidiaries.

Our research found there were numerous other organizations and nonprofits, such as trade alliances and industry organizations, that were involved in the standards sphere but did not specifically set standards themselves. In operationalizing this research area, we concluded that in order to be categorized as a standards body, the organization must be actively engaged in the setting or making of 5G standards rather than merely lobby or work to influence those standards. We noticed our research was honing in on a few primary international bodies, either operated through the United Nations (UN) or other larger regional alliances like the Organization of American States (OAS). After an exploration of the sources, we decided to operationalize this section by the names of international standards bodies that countries are either a part of, are members of, or actively participate in, to capture the primary international and domestic standards bodies that a country currently engages with on 5G standards.

Domestically Manufactured Components

Research Question: What 5G-related hardware and software components were manufactured in the country?

Manufacturing and production lend insight into the international supply chain and who wields the greatest resources and capacity for 5G development. We conceptually outlined this section to include which companies were currently manufacturing technologies used in 5G networks. Given that our sample boasted different levels of 5G development, our scope of analysis also included companies that manufactured technologies that could support 5G networks in the near future, but had not yet been directly integrated. The emphasis on in-country manufacturing is important here as it separates the criteria of this section from the following global stakeholders section.

The international nature of most technology manufacturing meant we had to develop clear boundaries on what fit into the dataset. We focused on identifying which companies were physically located within a country's borders. This most often included companies that were established or founded in a country and still had manufacturing operations there. However, this category also includes foreign companies that own and operate manufacturing facilities within another country. For instance, Taiwan’s TSMC building a semiconductor manufacturing plant in the US, China’s Huawei building a manufacturing plant in France, or the US’s Inventus Power manufacturing batteries in Brazil, were classified as being in the US, France, and Brazil. In each of these cases, a foreign multinational firm was included in domestic manufacturing because they built or produced hardware within that respective country, and thus were part of that country’s workforce towards 5G. In terms of counting for a particular country, then, we included companies that originated in the country, are currently headquartered there, and/or had domestic manufacturing or production facilities.

The breakdown of the top five hardware and software technologies supporting 5G included radio access towers, microchips, batteries, cloud computing solutions, and machine learning solutions.

Hardware. For the hardware components, we focused on radio towers, microchips, and batteries because of their structural importance in 5G infrastructure. For radio access towers, this included companies that built, manufactured, or had a stake in the production of radio and antennae infrastructure. For microchips, this included firms that built or manufactured semi-conductors and microchip technology. For batteries, this included companies that built or manufactured batteries, battery farms, or energy solutions.

Software. For the software components we focused on cloud computing solutions and machine learning solutions. Pinpointing where software solutions were manufactured proved to be ambiguous at times, likely because these technologies are not manufactured in single physical locations like hardware tends to be. Instead, software is distributed over global networks of computers or located near data centers and other computing infrastructure. For these reasons, we relied on where a company originated and where it was headquartered. In this way, we could accurately capture which domestic companies made and operated cloud and artificial intelligence (AI) technologies and used them in domestic markets. For instance, regardless of multinational affiliations, if the company originated in a certain country, was still headquartered there, and their technology had a market presence, its cloud computing services or machine learning solutions were considered domestic to that country.

Global Stakeholders

Research Question: Who were the primary international companies that were involved in and supported the country’s 5G rollout?

Throughout our research, we repeatedly found that multinational firms were heavily involved in nearly every country’s 5G rollout. Though these multinational firms did not necessarily manufacture 5G hardware or software components domestically, they provided some form of hardware, infrastructure, software solution, or 5G service within that respective country. We decided on only international and non-domestic firms in the global stakeholders section and differentiated between hardware and software because it was consistent with the breakdown of the manufacturing section. Furthermore, this breakdown became increasingly clear given the type of solution or service offered -- while 5G systems/hardware typically focused on contractual support between companies for complete 5G services, 5G software tended to center around the global locations of cloud services, machine learning solutions, and data centers. Thus, the section was broken down by companies that offered complete 5G services and infrastructure (e.g. 5G systems/hardware) and those that offered software solutions for 5G networks (e.g. 5G software), to understand their involvement and support in a country’s 5G rollout.

5G Systems/Hardware. Our team discerned there are only a handful of dominant corporations around the world that offer 5G radio hardware and complete 5G services who recurrently figured in our analysis. These companies included Samsung, Nokia, Ericsson, Qualcomm, Huawei, and ZTE. These companies typically have contracts with domestic carriers to support their deployment of 5G networks and services. This was commonly seen in the form of partnerships with domestic wireless providers supporting 5G rollout, contracts supplying hardware, telecommunications infrastructure or radio towers, offering software and network solutions, or any combination of the above. As examples, take Samsung’s contract with US Cellular providing 5G network solutions including 5G New Radio (NR) technology, Huawei partnering with South Africa’s Rain offering end-to-end 5G solutions, or Qualcomm and Saudi Arabia’s Dallah entering into a patent licensing agreement providing small cells for the country’s 5G deployment.

5G Software. In addition to the six primary firms offering complete 5G services, our team repeatedly found multinational technology firms offering software solutions in support of a country’s 5G rollout. These companies primarily included Amazon Web Services (AWS), Google, Microsoft, IBM, Oracle, Alibaba, and Huawei, to name a few. The 5G software subsection included companies that partnered with or had contracts with countries or companies to provide cloud services, machine learning solutions, expanded data center infrastructure in support of software applications, or offered an emerging technology in support of 5G. Take for instance, AWS launching Wavelength in Europe and Asia to support cloud computing on 5G, Nvidia landing a contract with China Mobile to offer a cloud-based edge supercomputing platform for 5G, or IBM opening a new data center in South Korea to offer cloud infrastructure services. Importantly, data center expansion was consistently found in conjunction with software offerings in many countries, yet another indicator of strong international involvement in the 5G rollout of various nations. Overall, the Global Stakeholders analysis focused on which multinational firms were supporting in-country 5G deployment and how large of a footprint they had on the global market.

In summary, this infographic presents a snapshot of 5G Around the Globe in 2020. Using the same methodology, and a comparable sample of countries from the G20, we intend to publish annual updates to this research. The infographic is one component of the Wilson Center’s 5G Beyond Borders project. For more information on this initiative, please visit our website.

Author

Science and Technology Innovation Program

The Science and Technology Innovation Program (STIP) serves as the bridge between technologists, policymakers, industry, and global stakeholders. Read more

Explore More

Browse Insights & Analysis

Forecasting American Crypto Policy in 2025